are union dues tax deductible in 2020

Membership dues for trade unions or public servant associations may be deducted on income tax returns. If you belong to a union or professional organization you can deduct certain types of union dues or professional membership fees from your income tax filings.

Which Charitable Contributions Are Tax Deductible Infographic Turbotax Tax Tips Videos

As set forth in the new tax rules any membership dues you pay to a club for business recreation leisure country club or other social purposes are not deductible.

. Union Dues or Professional Membership Dues You Cannot. Tax reform changed the rules of union due deductions. If youre self-employed you can deduct union dues as a business expense.

If youre a teacher paying union dues only your dues toward negotiating pay and benefits can be deducted from your income taxes. Union dues and professional association fees are tax deductible. In a month union fees are normally collected for you by monthly planning but the really good news is that your union fees are 100 deductible for all of your taxes for the year.

However if the taxpayer is self-employed and pays union dues those dues are deductible as a business expense. This publication explains that you can no longer claim any miscellaneous itemized deductions unless you fall. Under current federal law union dues are generally not deductible.

And according to the IRS the following can still. Tax reform eliminated the deduction for union dues for tax years 2018-2025. Thanks to union victories the educator expense tax deduction has been renewed for 2020 returns - and theres a state deduction for your union.

You may still take a 100. If youre a private-sector union member. Are union dues tax deductible 2020.

However there are a few exceptions and if your union dues meet one of them you are in luck. When union dues are tax deductible If youre self-employed and pay union dues you can deduct them as a business expense. You can also claim up to 42 per.

Tax reform changed the rules of union due deductions. Subscriptions to trade business or professional. Union fees subscriptions to associations and bargaining agents fees.

At 15 per cent of total earnings MoveUPs dues are lower than most Canadian unions. For tax years 2018 through 2025 union dues and all employee expenses are. Claiming union dues twice can result in a notice of reassessment and a possible penalty tax and interest owing.

If a tax-exempt organization notifies you that part of the dues or other amounts you pay to the organization are used to pay nondeductible lobbying expenses you cant deduct that part. A reminder for tax season. The employee expenses are treated as an item deductible deduction by Line 21 of.

Deductible membership fees can be deducted from union dues and membership fees. For the industry you work in you can claim a deduction for. The amount of union dues that.

For tax years 2018 through 2025 union dues and all employee expenses are no longer. How much union dues can I deduct. However most employees can no longer deduct union dues on their federal tax return in tax years 2018.

UnionMembership fees are tax deductible If you pay work-related union or membership fees you can claim the total cost of these fees. Are union dues included in gross. Professionals who are required by law to pay dues for professional boards.

Can I deduct my union dues in 2020.

The Ultimate Tax Deduction Checklist Howstuffworks

What Are Payroll Deductions Article

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Bonus Paystub Template 01 Payroll Template Templates Paycheck

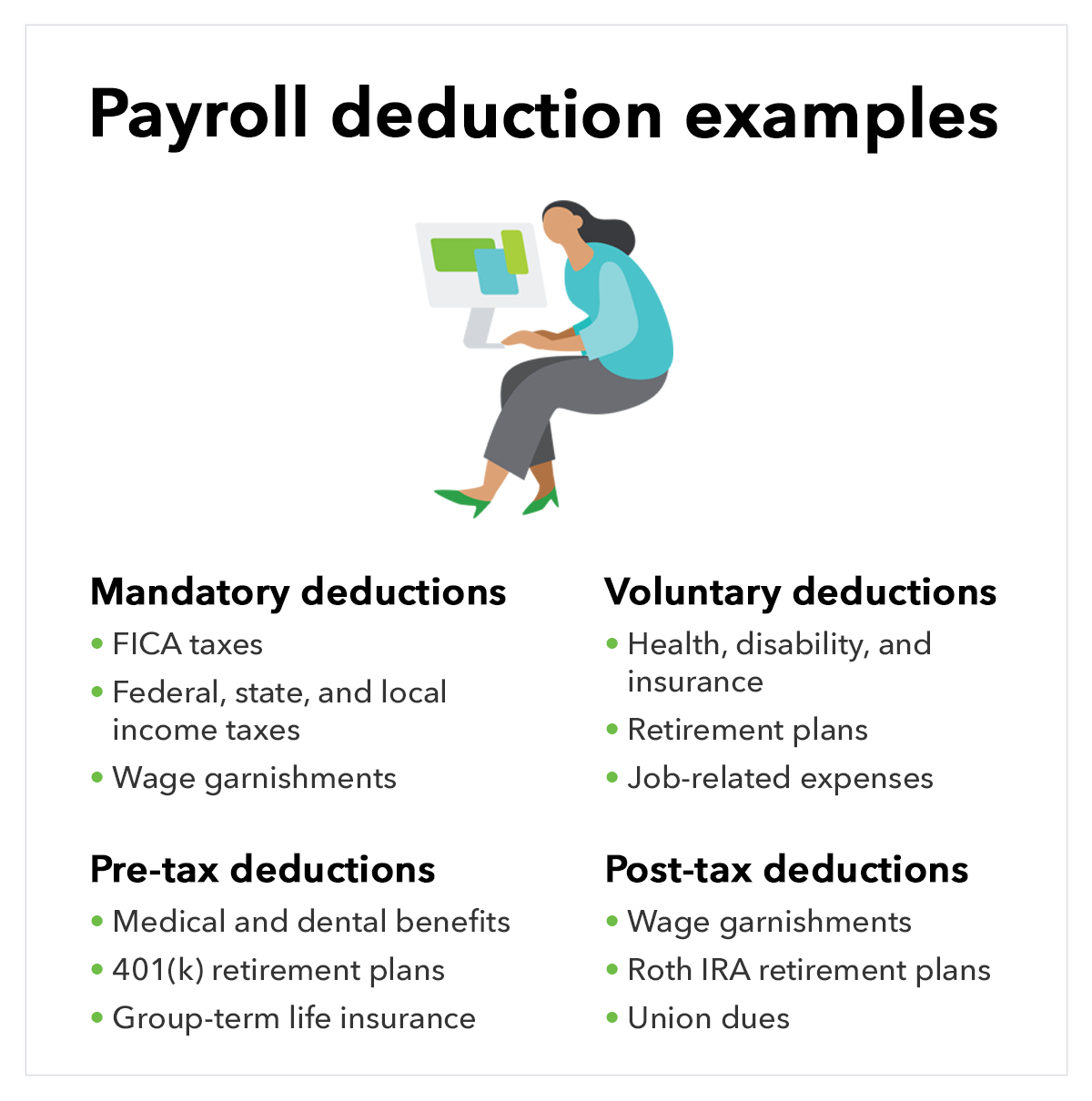

Different Types Of Payroll Deductions Gusto

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

2020 Year End Tax Tips For Canadians Cloudtax Simple Tax Application

What Are Payroll Deductions Article

How To Claim Union Dues On The Tax Return Filing Taxes

Union Professional And Other Dues For Medical Residents Md Tax

Personal Income Tax Deductions In Canada 2022 Turbotax Canada Tips

What Are Pre Tax And Post Tax Payroll Deductions Hourly Inc

Taxable Benefits Explained By A Canadian Tax Lawyer

What Expenses Can Be Claim On Tax Deductions Without Receipts

6 Overlooked Tax Deductions And Credits That Could Score You A Big Return National Globalnews Ca

The Ultimate Self Employed Deduction Cheat Sheet Exceptional Tax Services Bookkeeping Business Small Business Planner Small Business Plan